As I had mentioned in my post "What do recent events mean for the EU and economic policy in the eurozone?", part II and III, the IMF's World Economic Outlook of October 2012 presented new evidence of a larger than assumed fiscal multiplier, now found to be in the order of between 0.9 and 1.7, instead of 0.5 as previously estimated (see WEO 2012. chapter 1, box 1.1).

Before thís momentous concession that IMF economists had underestimated the fiscal multiplier, there were three different 'camps' regarding the impact of austerity on economic growth:

1.) The 'expansionary austerity' camp [fiscal multiplier = 0]

Proponents of the expansionary austerity view argue that fiscal contraction would not only NOT reduce economic growth, but might even enhance growth through exchange rate and confidence effects. The supply-side research papers of Alberto Alesina have been particularly influential in certain economic policy circles and were quickly picked up by European policymakers as a justification for the austerity programs imposed on Greece and other Southern European countries in return for EU financial assistance. While German finance minister Schäuble is a staunch supporter of the expansionary austerity school, Larry Summers thinks "that the idea of expansionary austerity is oxymoronic"...."you can drop the prefix." (see my post "Austerity chickens are coming home to roost in Germany").

2.) The mainstream camp [fiscal multiplier = 0.5]

This camp, which included the IMF and the Bank of England, held that the impact of austerity on economic growth would be significant, but only moderately so. Examining data from the last three decades, the IMF concluded in October 2010 that "fiscal consolidation typically lowers growth in the short term."...."we find that after two years, a budget deficit cut of 1 percent of GDP tends to lower output by about 1/2 percent and raise the unemployment rate by 1/3 percentage point." (see press points for chapter 3, World Economic Outlook 2010)

3.) The 'recessionary austerity' camp [fiscal multiplier > 1]

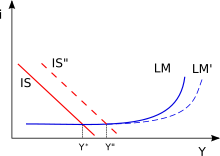

The chart above shows the liquidity trap as visualized in a IS-LM diagram. A monetary expansion (the shift from LM to LM') has no effect on equilibrium interest rates or output. However, fiscal expansion (the shift from IS to IS") leads to a higher level of output with no change in interest rates.

-----------------------------------------------------------------------------------------------------------------------------------------

What does all this mean for the eurozone ?

Economists in the third camp, including Paul Krugman, Brad Delong, Martin Wulf (Financial Times) and Simon Wren Lewis, argue that the experience of the last three decades is not relevant to today's liquidity trap environment. In a liquidity trap environment, central banks' injections of cash into the banking system fail to stimulate economic growth because banks and people hoard cash. As people expect insufficient aggregate demand and/or deflation, they prefer to hoard their money instead of investing or consuming it, so that the impact of monetary policy is either zero or very moderate due to its limitation by the zero lower bound of interest rates. In such a situation, only fiscal policy will have an impact on economic growth, with the fiscal multiplier most likely larger than 1. For the eurozone, this means that each €uro of fiscal austerity will reduce economic activities by >1 €uro, specifically by between €0.9 and €1.7.

-------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------

The chart above shows the liquidity trap as visualized in a IS-LM diagram. A monetary expansion (the shift from LM to LM') has no effect on equilibrium interest rates or output. However, fiscal expansion (the shift from IS to IS") leads to a higher level of output with no change in interest rates.

-----------------------------------------------------------------------------------------------------------------------------------------

Since October 2012 I believe it is fair to say that at least the IMF's Chief economist and his team of economists have moved from the mainstream camp to the recessionary austerity camp. Here is the key paragraph of their research findings on fiscal multipliers: "Our results indicate that multipliers have actually been in the 0.9 to 1.7 range since the Great Recession. This finding is consistent with research suggesting that in today's environment of substantial economic slack, monetary policy constrained by the zero lower bound and synchronized fiscal adjustment across numerous economies, multipliers may be well above 1." (see WEO of October 2012)

What does all this mean for the eurozone ?

In view of economic developments in the eurozone since the Great Financial Crisis in 2008, one doesn't have to be an economist to conclude that ECB monetary policy has been ineffective in terms of its impact on economic growth: while interest rates reached historically low levels, economic activity has slumped in the periphery and slowed down in the core, with banks withholding credit and corporations postponing investments; with consumers foregoing consumption, prefering to put their money under the mattress or depositing it in other countries perceived as safe havens (predominently Germany, Luxemburg, or Switzerland).

Anybody with common sense can also observe that fiscal policy has had a severe impact on the economies of the eurozone's Southern periphery: In Greece, the fiscal contraction imposed by the troika to lower the country's debt in relation to its GDP caused a dramatic slump in GDP, from €249 bln in 2009 to €194 bln in 2012. Instead of lowering the debt ratio, the economic contraction increased the burden of Greek debt in relation to its dramatically lower GDP from 120% in 2009 to 176.7% of Greek GDP in 2012 (Eurostat data). This suggests that the fiscal multiplier has indeed been much larger than 0.5 as initially estimated by the IMF in 2010. Applying the IMF's revised multiplier estimate of 1.7, the new fiscal cuts of €13.5 bln just approved by the Greek parliament would lower Greek GDP by €23 bln to €171 bln, increasing the debt ratio to 203% of GDP ! At that point, Greece would need another €100 bln from the European taxpayer just to keep it going.

Similar fiscal multiplier effects can be observed in Spain and Portugal. Instead of putting the Southern periphery on a path toward sustainable growth, the austerity polices imposed by the troika have dramatically lowered the countries' GDP, thus increasing public debt ratios and creating a humanitarian crisis so dramatic that it provokes regular massive demonstrations against the inhumane spending cuts focused on the weakest members of society: the old, the young, and the poor.

The conclusion is obvious to anybody but the Very Serious People in power: A continuation of the austerity policies in the eurozone worsen the debt burden and the humanitarian crisis in the countries of the eurozone's periphery, reinforce the trend toward violent opposition and foster the growth of militant, nationalist movements. These trends already threaten "Europe's cohesion and the ideals behind the European Union" (George Soros) and seriously endanger the 60-year peace period in Europe, mocking the recently awarded Nobel Peace prize.

Hence, it is urgent and indispensable to immediately STOP the austerity measures, take up Mr. Soros' offer to "commit serious financial resources", and design a more appropriate, sustainable, and humane economic adjustment strategy for the entire eurozone.

Hence, it is urgent and indispensable to immediately STOP the austerity measures, take up Mr. Soros' offer to "commit serious financial resources", and design a more appropriate, sustainable, and humane economic adjustment strategy for the entire eurozone.

No comments:

Post a Comment