As announced in my last

blog, I really wanted to write about a cockroach zombie roaming Germany and certain neighborhoods in Brussels. However, faced with an extraordinary Cyprus crisis cliffhanger, that will have to wait ‘til next time.

Due to the usual

incompetence of EU officials combined with the incompetence and

boneheadedness of leading German officials, we now have a situation

in the eurozone which could lead to the collapse of the Cyprian

banking system and the Cyprian economy if €5.8 bln in cash cannot

be scraped together by Monday, March 25, the last day of

ECB-liquidity help to the Cyprians. The euro crisis is back !

As no doubt you have all

followed in the media, the catastrophy began to unfold when the gang

of four (EU commissioner Olli Rehn, a representative of the IMF, ECB board memberAsmussen and German finance minister Schäuble) pretty much

blackmailed the new president of Cyprus, Nikos Anastasiades, to finance a part of the EU bail-out with an obligatory tax of 9.9% on uninsured Cyprian bank deposits of €100.000 and above and a 6.75% tax on insured deposits below €100.000,

effectively dismantling the EU deposit insurance guarantee. Otherwise, the ECB would

stop its liquidity help to Cyprus' banks which would mean an immediate disorderly

default. Mr. Anastasiades had no choice but to accept this poisonous

deal.

While financial

markets remained calm as the ECB reinsured investors that liquidity

would be supplied to Cyprus' banks, the financial media, finance

experts, and the Cyprian population went haywire when the news of the

depositor bail-in became public. Some commentators called it “an

unbelievably stupid decision”; a former ECB official from Cyprus

even threatened that Cyprus would now sell gas exploitation licenses of recently discovered natural gas fields to Russia instead of the EU.

The best comment I read was only slightly more diplomatic, calling

the deal “a huge blunder” and pointing out that, if

the deal were to be approved by the Cyprian parliament, the EU would

get the required €5.8 bln cash contribution to release €10 bln in EU-aid, yet it would still be too little, too late as depositors would withdraw all their deposits as soon as Cyprian banks reopened. The alternative (i.e. non-approval of

the deal) would lead to the disorderly default of Cyprus' banks and

possibly another massive bank crisis in other eurozone countries (see "Cyprus: the next blunder", March 18, 2013).

Today, 6 days later,

we know that the Cyprian parliament rejected the deal and is

desperately searching for another way to come up with the

required €.5.8bln. The Russians have turned them down. The disorderly bank failures have not (yet)

occurred as the ECB continues its liquidity provision until Monday, March 25. After that date, all bets are

off. Interestingly, financial markets remained calm until the day the

ECB made public the March 25 deadline. Since then, both equity and

credit markets have reacted nervously. Depositors in other countries,

however, apparently view the Cyprian situation as special and have

not withdrawn their deposits. That is where we stand.

Now, it is easy to

criticize the depositor bail-in deal without knowing all the facts, but

difficult to come up with a better alternative in a strained

situation. However, knowing our charm- and courtesy-challenged, boneheaded German

machos, I am sure one could have easily handled the situation better

and come up with a more democratic solution if one had treated the

Cyprians with a little respect and negotiated with them as true

partners, instead of assaulting them with a 'take-it or else'-type of proposition. My advice: next time in a

critical situation, the EU should employ an all-women negotiating

team !

The uproar in Cyprus has been gigantic, with swasticas and Merkel in nazi uniform displayed on many protest signs on the streets of Nicosia. With ongoing anti-austerity protests in Greece, Spain, Portugal and the 'vaffanculo' message from Italians, Germany now is easily the most hated country in the eurozone, its hard-won post-war reputation in shambles. Congratulation to the Merkel government ! We needed that like a hole in the head.

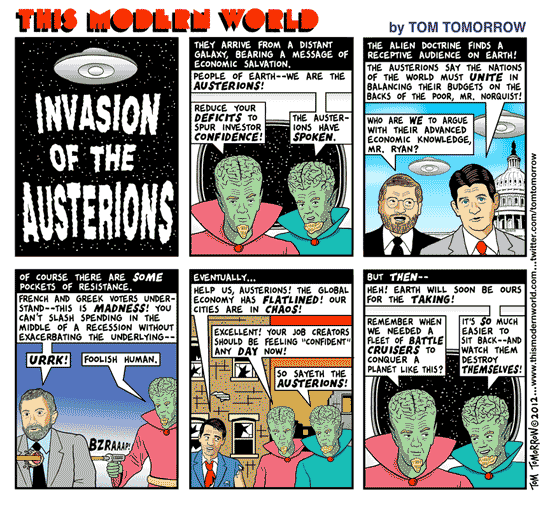

Olli Rehn, the EU commissioner already ridiculed and battered by Paul Krugman who labeled Rehn's policy decisions "cockroach ideas", has to serve as the scapegoat. Bloomberg reports that Rehn faced "a torrent of critiscm and a call to resign after helping broker a rescue package for Cyprus that fell apart." Nessa Childers, an Irish member of the EP, said in a telephone interview with Bloomberg: "Somebody somewhere has to be accountable and the buck stops with him"..."This was not only undemocratic, but incompetent. Was anyone thinking about the big picture?"

Right she is ! I think (and I'm not the only one), we need an entirely new, democratically elected leadership team for the eurozone. But first of all, the whole EU commission team responsible for the austerity policies plus the entire Merkel government should be fired. Let's do it at the ballot box this September !

Here is a good solution for the Cyprus crisis: take a page out of the book of Iceland.

Here is a good solution for the Cyprus crisis: take a page out of the book of Iceland.